what is disposal of asset under the real property gains tax act 1976

Form CKHT 1B - Disposal of share in Real Property Companies RPC Form CKHT 3 - Notification of Disposal of Asset not Subject to Tax or Exempt from the Payment of Tax. Section 4 331a and 99.

Income tax is payable on assessable income which falls under two broad categories.

. The Soviet Union served 35 million men and women with the US serving 16 million Germany 13 million the British Empire. Calculation of income or gain on remittance basis where special withholding tax levied. Government Publishing Office Page 3387 WILLIAM M.

Enter the email address you signed up with and well email you a reset link. 1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real property hereinafter referred to as chargeable asset. If you are a foreign person or firm and you sell or otherwise dispose of a US.

Real property interest the buyer or other transferee may have to withhold income tax on the amount you receive for the property including cash the fair market value of other property and any assumed liability. The information provided here is only a basic summary of capital gains tax issues which are very complicated. Where the beneficiary is a tax-exempt body or is not a resident of Australia.

Jingga Jaya Sdn Bhd v. Restriction on losses carried forward where tax credit claimed. Provisions about the deemed tax under section 139.

The disposal of assets which have been held since before 20 September 1985 when capital gains tax went into effect are exempt from CGT. Amount of tax credit. Come and visit our site already thousands of classified ads await you.

The Homestead Acts were several laws in the United States by which an applicant could acquire ownership of government land or the public domain typically called a homesteadIn all more than 160 million acres 650 thousand km 2. When an executor or administrator sells an asset. 1108-6 Limitations on the exclusion of income from the discharge of qualified real property business indebtedness.

Sections 8 and 13a of the International Banking Act of 1978 12 USC. Part II Schedule 5 Real Property Gains Tax Act 1976. Section 7j13 of the Federal Deposit Insurance Act.

1108-5 Time and manner for making election under the Omnibus Budget Reconciliation Act of 1993. Tax credit under section 1054 of CTA 2009. 116th Congress Public Law 283 From the US.

Use Form 8824 Like-Kind Exchanges to report exchanges of qualifying business or investment real property for real property of a like kind. What are you waiting for. Notwithstanding section 3 tax shall not be charged under this Act on income in respect of an offshore business activity carried on by an offshore company.

Capital gains tax credit etc for special withholding tax. Taxation of chargeable gains 3. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Form CKHT 1A - Disposal of Real Property. Almost every country in the world participated in World War IIMost were neutral at the beginning but only a relatively few nations remained neutral to the end. Tax credit under section 1054 of CTA 2009.

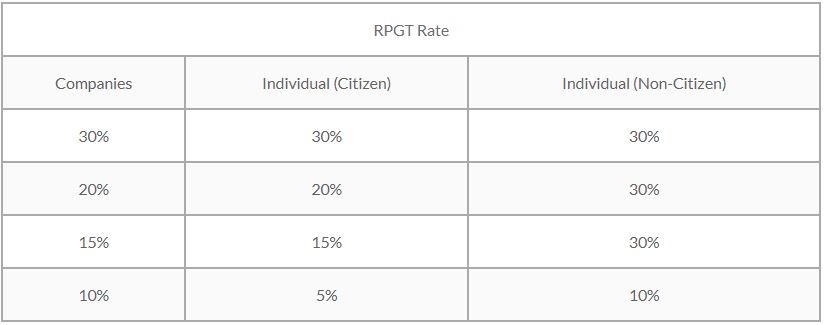

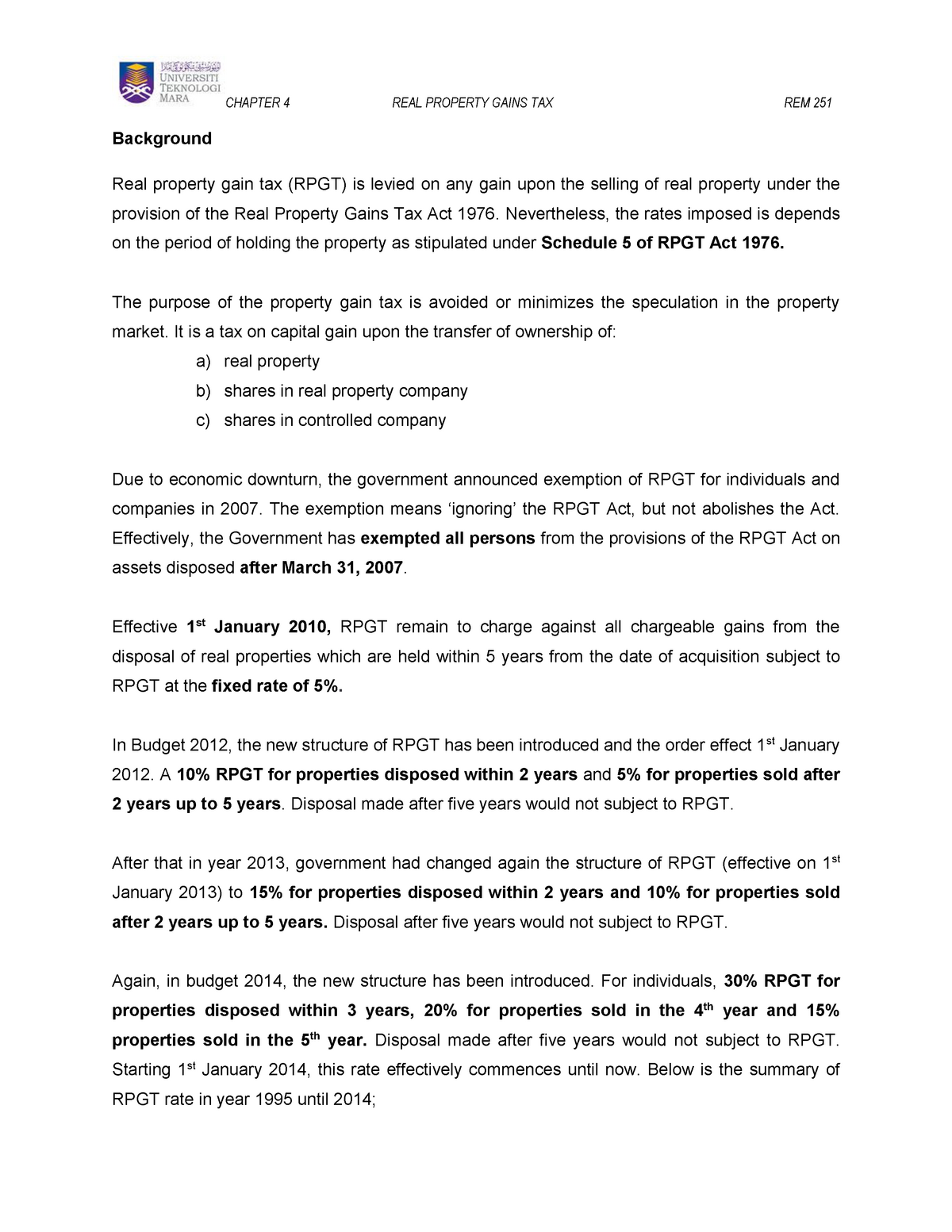

Ohio oʊ ˈ h aɪ oʊ is a state in the Midwestern region of the United StatesOf the fifty US. Real Property Gains Tax RPGT Rates. For purposes of the preceding sentence so much of the net investment income as defined in section 163d3A of such Code for any taxable year as is not taken into account under section 163d of such Code as amended by this Act by reason of the last sentence of section 163d3A of such Code shall be taken into account for purposes.

Its easy to use no lengthy sign-ups and 100 free. Deleted by Act 578. Director General of Inland Revenue New.

Effective from 01012010 disposer and acquirer are required to submit Real Property Gains Tax RPGT Forms as follows. During the tax year the estate or trust sold or otherwise disposed of section 1250 property generally real property that was depreciated held more than 1 year. Order 53 of the Rules of Court 2012.

2 Subject to this Act the tax shall be charged on every ringgit. Where deferred tax asset is recoganised against unabsorbed depreciation or carry forward of losses under tax laws it is recognised only to the extent that there is virtual certainty supported by convincing evidence that sufficient future taxable income will be available against which such deferred tax assets can be realised. CHAPTER 10 Remediation of contaminated or derelict.

3388 Public Law 116-283 116th Congress An Act To authorize appropriations for fiscal year 2021 for military activities of the Department of. Classes of income on which tax is chargeable 4. Enter the amount that would be the taxable income of the REIT for the tax year if only recognized built-in gain recognized built-in loss and recognized built-in gain carryover were taken into account reduced.

Where a beneficiary sells an asset after acquiring it from an estate. Additional deduction under section 1087 of CTA 2009. This part Regulation Y is issued by the Board of Governors of the Federal Reserve System Board under section 5b of the Bank Holding Company Act of 1956 as amended 12 USC.

MAC THORNBERRY NATIONAL DEFENSE AUTHORIZATION ACT FOR FISCAL YEAR 2021 Star Print Page 134 STAT. It is the Services position that a shareholderemployee who receives a salary for services rendered is engaged in a trade or business for purposes of IRC 482. 250 thousand sq mi of public land or nearly 10 percent of the total area of the United States was given away free to 16 million homesteaders.

The Second World War pitted two alliances against each other the Axis powers and the Allied powers. The Tax Court held that the taxpayers lease of real property equipment and furnishings to a corporation that the taxpayer owned was a trade or business within the meaning of IRC 482. Capital gains tax may be payable.

Disposal Date And Acquisition Date. Complete the Built-in Gains Tax Worksheet to figure the built-in gains tax under Regulations section 1337d-7 or 1337d-6. If you have many products or ads create your own online store e-commerce shop and conveniently group all your classified ads in your shop.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. 1108-4 Election to reduce basis of depreciable property under section 108b5 of the Internal Revenue Code. States it is the 34th-largest by area and with a population of nearly 118 million is the seventh-most populous and tenth-most densely populatedThe states capital and largest city is Columbus with the Columbus metro area Greater Cincinnati and Greater Cleveland being the largest.

The estate or trust received installment payments during the tax year for section 1250 property held more than 1 year and is reporting gain on the installment method. Credit under Chapter 2 of Part 2 to be allowed first. Real property interests by foreign persons.

Judicial Review Assessment Under ITA 1967. Amount and application of the deemed tax under section 137. For exchanges of real property used in a trade or business and other noncapital assets enter the gain or loss from Form 8824 if any on Form 4797 line 5 or line 16.

Subject to this Act the income upon which tax is chargeable under this Act is income in respect of--. Ordinary income Income Tax Assessment Act 1997 Cth s 65ITAA97 and statutory income. Chapter 7 of Part 13 of CTA 2009.

All classifieds - Veux-Veux-Pas free classified ads Website.

Capital Gains Tax In The United States Wikipedia

Joyous One Child Care Centre 1

Timing In Filing Real Property Gains Tax Forms

Assignment 1 Rpgt Docx Individual Assignment 1 Rpgt Format Due Date 4 5 Pages Single Spacing Times New Roman Font 12 8 June 2021 Tuesday Real Course Hero

What Is Real Property Gains Tax The Malaysian Bar

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Did You Know That You Need To Pay Real Property Gains Tax If You Made A Profit From Sale Of Your Property Case Facts By Hhq Law Firm In

Real Property Gains Tax Jpph This Tax Is Providedvenue Board Irb On Chargeable Gains For In The Studocu

Capital Gains Tax In The United States Wikipedia

All You Need To Know About Real Property Gains Tax Rpgt

Chapter 4 Untuk Dijadikan Rujukan And Contoh Kepada Pelajar Pelajar Uitm Diseluruh Malaysia Studocu

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Malaysia Personal Income Tax Guide 2021 Ya 2020

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Taxability Of Reit Under The Real Property Gains Tax Act 1976 Lexology

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

0 Response to "what is disposal of asset under the real property gains tax act 1976"

Post a Comment